Creating a painting invoice might not be as thrilling as putting the final touches on your latest masterpiece, but it's a crucial part of running a successful painting business. A well-crafted invoice ensures you get paid on time, keeps your business records organized, and provides clients with clear documentation of services rendered. In this guide, we'll break down how to write a painting invoice that‘s both professional and easy to understand. You can focus more on painting and less on paperwork.

Why a Professional Invoice Matters

Invoices aren't just about getting paid. They're a reflection of your business. Think of them as an extension of your brand. A professional invoice can enhance your credibility, making you stand out in the crowded painting industry. Here‘s why it‘s important:

- Clarity and Transparency: A well-structured invoice prevents misunderstandings by clearly outlining the services provided and the associated costs.

- Legal Protection: Invoices serve as a record of transactions, which can be crucial if disputes arise.

- Branding Opportunity: Your invoice can include your logo and other branding elements, reinforcing your business identity.

So, let's transform that dull piece of paper into a professional document that represents your artistry and business acumen.

The Basics of a Painting Invoice

Before we jump into the design and details, let‘s cover the foundational elements every painting invoice should include. Missing even one of these can lead to delays in payment or potential disputes. Here‘s what you need:

- Header: This includes your business name, logo, and contact information. Make sure it‘s easily recognizable.

- Invoice Number: A unique identifier for each invoice, crucial for record-keeping and tracking payments.

- Client Information: The name and contact details of the person or company you did the work for.

- Invoice Date: Clearly state the date the invoice is issued.

- Payment Terms: Outline when you expect payment. Common terms are

Net 30,which means payment is due 30 days from the invoice date. - Service Details: A breakdown of the work performed, including descriptions and itemized costs.

- Total Amount Due: The grand total, including any taxes.

- Payment Methods: Specify how clients can pay, whether it‘s via check, bank transfer, or other methods.

- Notes and Terms: Any additional information, such as warranty details or late payment penalties.

Now that we‘ve covered the essentials, let's dive into creating each part of the invoice step by step.

Designing Your Invoice Header

The header is the first thing your clients will see, so make it count. It sets the tone for the rest of the invoice. Here‘s how to make it shine:

- Business Name and Logo: Place your business name and logo prominently at the top. Make sure the logo is clear and not pixelated.

- Contact Information: Include your address, phone number, email, and website (if applicable). This makes it easy for clients to get in touch if they have questions.

A well-designed header not only looks professional but also helps with brand recognition. Here‘s a quick example:

[Your Business Name]

[Your Logo]

123 Paint Lane

Colorville, CA 90210

Phone: (123) 456-7890

Email: info@yourbusiness.com

Remember, consistency is key. Use the same header design across all your business documents for a cohesive brand image.

Assigning Invoice Numbers

Invoice numbers might not sound exciting, but they‘re crucial for keeping your records straight. Here‘s how to do it:

- Unique Identifier: Each invoice should have a unique number. This helps you and your clients track payments and manage records.

- Consistent Format: Choose a format and stick with it. For example, you might use a combination of the date and a sequence number, like 2023-001.

- Organizational Benefits: Proper numbering makes it easier to find invoices later, especially during tax season or audits.

Here‘s an example of what an invoice number might look like:

Invoice #: 2023-001

By establishing a numbering system early, you set the stage for a smooth invoicing process as your business grows.

Adding Client Details

Including your client‘s contact details seems straightforward, but accuracy is essential. Here‘s what to include:

- Client‘s Name: Use the name of the person or business you‘re invoicing.

- Contact Information: Include the client‘s address, phone number, and email.

Here‘s a sample format:

Bill To:

John Doe

456 Canvas Ave

Artville, CA 90211

Phone: (987) 654-3210

Email: john.doe@example.com

Ensuring this information is correct helps avoid payment delays and maintains a professional relationship with your clients.

Setting the Invoice Date

The invoice date is more than just a formality. It‘s the starting point for payment terms. Here‘s how to handle it:

- Invoice Date: The date you issue the invoice. This is crucial for calculating due dates and managing cash flow.

- Due Date: Based on your payment terms, this is when you expect to receive payment. Clearly state it on the invoice to avoid confusion.

An example format might look like this:

Invoice Date: March 1, 2023

Due Date: March 31, 2023

Clear dating helps both you and your clients stay on track with payments.

Itemizing Services and Costs

An invoice should clearly reflect the work you‘ve done. Here‘s how to itemize your services effectively:

- Service Description: Provide a brief but clear description of the services rendered.

- Quantity: If applicable, include the quantity of materials used or hours worked.

- Unit Price: Indicate the price per unit or hour.

- Total Cost: Calculate the total cost for each service and materials.

Here‘s a sample itemization:

Description | Quantity | Unit Price | Total

-------------------------------------------------

Interior Painting | 1 | $1,000 | $1,000

Paint Supplies | 10 | $15 | $150

Labor (20 hours) | 20 | $50 | $1,000

-------------------------------------------------

Total: $2,150

Clear itemization helps clients understand what they‘re paying for and minimizes disputes.

Summing Up: Total Amount Due

The total amount due is the grand finale of your invoice. It shows your clients exactly what they owe. Here‘s how to present it:

- Subtotal: Sum all the itemized costs.

- Taxes: If applicable, add sales tax or other relevant taxes.

- Total Amount Due: This is the final amount the client owes.

A typical summary might look like this:

Subtotal: $2,150

Sales Tax (8%): $172

Total Amount Due: $2,322

By clearly stating the total due, you make it easy for clients to understand and pay the correct amount.

Specifying Payment Methods

Making it easy for clients to pay you is, naturally, in your best interest. Here‘s how to specify payment methods:

- Accepted Methods: List all the methods you accept, such as checks, credit cards, or bank transfers.

- Instructions: Provide any necessary instructions, such as who to make checks payable to.

Here‘s a sample payment section:

Payment Methods:

- Check: Make payable to [Your Business Name]

- Bank Transfer: Account #123456, Routing #654321

- Credit Card: Contact us at (123) 456-7890

Providing clear payment options helps ensure you get paid without unnecessary delays.

Adding Additional Notes and Terms

The notes section is your chance to communicate any additional information. Here‘s what you might include:

- Late Payment Penalties: If applicable, state any late fees or penalties for overdue payments.

- Warranty or Guarantee: Mention any warranties or guarantees related to your work.

- Personal Touch: A short thank you message can reinforce client relationships.

Here‘s an example:

Notes:

Thank you for your business! Please note that payments made after the due date will incur a 5% late fee.

Our work is guaranteed for 1 year from the date of completion.

By adding these notes, you not only protect your business but also show appreciation for your clients.

Using Spell to Simplify the Process

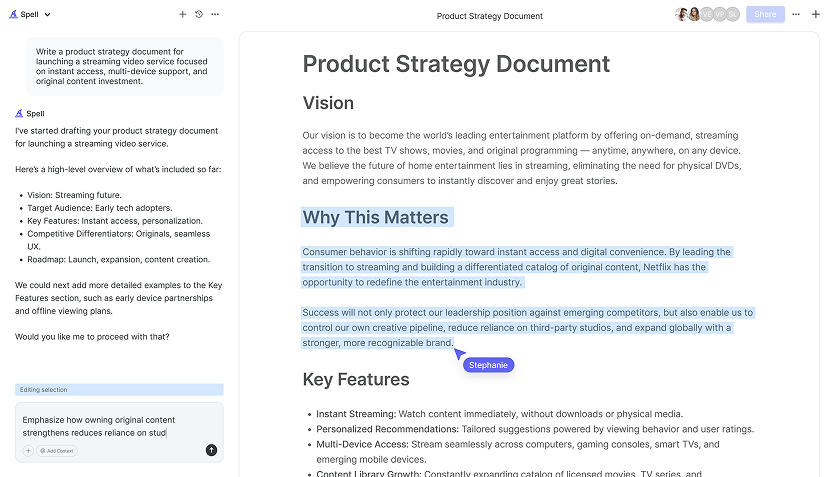

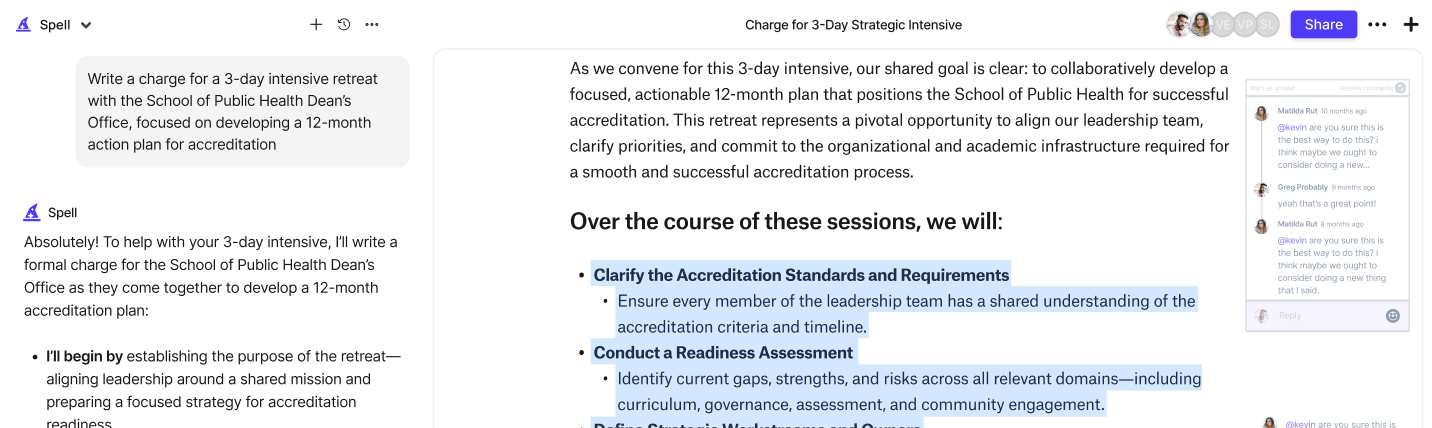

Let‘s be honest. Even with all this guidance, creating an invoice can still feel like a chore. Here's where Spell comes in handy. Imagine having an AI document editor that can help you draft your invoices in seconds. With Spell, you can create, edit, and share high-quality documents 10x faster than traditional methods.

Here‘s how Spell can make your invoicing process smoother:

- Generate Drafts Quickly: Describe the invoice you need, and Spell can whip up a draft in no time.

- Edit with Ease: Use natural language prompts to make changes without the hassle of formatting issues.

- Collaborate in Real-Time: Share your document and work with your team seamlessly, just like using Google Docs but with AI built in.

Whether you‘re a seasoned pro or just starting out, Spell can help streamline your invoicing process, giving you more time to focus on your art.

Final Thoughts

Creating a painting invoice doesn't have to be complicated. By following these steps and using tools like Spell, you can produce professional invoices with minimal effort. Remember, a clear and professional invoice not only helps you get paid on time but also strengthens your client relationships. With a bit of practice, you'll be invoicing like a pro in no time!