Writing a demand letter for payment can feel challenging, especially when you're trying to strike the right balance between firmness and professionalism. But don't worry, I'm here to guide you through the process. Whether you're seeking payment for services rendered, a personal loan, or any other type of debt, a well-crafted demand letter can be a powerful tool in resolving disputes. Let's dive into the details and ensure you're equipped to write a demand letter that gets the results you need.

Setting the Stage: Why a Demand Letter?

Before putting pen to paper (or fingers to keyboard), it's helpful to understand why a demand letter is often a smart first step in any payment dispute. A demand letter serves as a formal request for payment, clearly outlining the debt, the consequences of non-payment, and your willingness to resolve the matter amicably. Often, it's the first formal step in the debt collection process and can be a way to avoid costly legal proceedings.

Think of it as a chance to remind the debtor of their obligations while providing them with an opportunity to settle the matter without escalating it further. It's a professional way to initiate communication and can also serve as a valuable record if the situation moves to court.

Gathering Information: What You Need Before You Write

Preparation is key to crafting an effective demand letter. Before you start writing, gather all relevant information related to the debt. Here's a checklist to ensure you have everything covered:

- Amount Owed: Know the exact amount you're seeking. This includes principal, interest, and any applicable fees.

- Dates: Record the date the debt was incurred and the date it was due.

- Invoices or Contracts: Have copies of any invoices, contracts, or agreements that detail the terms of the debt.

- Communication History: Document any previous communication regarding the debt, such as emails or phone call logs.

- Payment Instructions: Decide how you want to receive payment (e.g., bank transfer, check) and have this information ready to include.

Having all this information at your fingertips will make the writing process smoother and ensure your letter is both accurate and comprehensive.

Crafting Your Opening: Making a Strong First Impression

The opening of your demand letter sets the tone for the rest of the correspondence. It should be clear, concise, and direct. Here's a straightforward way to start:

Dear [Debtor's Name],

I hope this message finds you well. I am writing to address an outstanding payment that is due to me...

By starting with a polite yet firm introduction, you acknowledge the debtor while also setting the stage for a serious discussion. Remember, the goal is to maintain professionalism while clearly stating your intention.

The Meat of the Letter: Describing the Debt

This section is where you detail the nature of the debt. Be specific and thorough, as this is the core of your letter. Include:

- Amount Due: Clearly state the total amount owed, including any interest or fees.

- Due Dates: Mention when the payment was initially due and any grace periods that have expired.

- Details of the Debt: Explain what the debt is for. Whether it‘s services rendered, goods delivered, or another type of obligation.

Here‘s how you might structure this section:

As of [Date], the total amount of $[Amount] remains unpaid. This amount was originally due on [Original Due Date] following the delivery of [Services/Goods]. Despite previous communications, the payment has not been received.

Keeping this section factual and to the point helps ensure there is no confusion about the debt being discussed.

Offering a Resolution: Providing a Path Forward

Next, offer a solution. This could be a simple request for payment by a certain date or more flexible terms if you're open to negotiation. Offering a resolution shows that you're willing to work with the debtor, which might encourage them to settle the debt promptly.

Consider including a statement like:

I am willing to offer a [discount/payment plan] if the payment is made by [Specific Date]. Please let me know if you would like to discuss this option further.

This approach can be particularly effective if you believe the debtor is genuinely unable to pay the full amount at once.

Consequences of Non-Payment: Clearly Stating the Stakes

It's important to outline the potential consequences of not addressing the debt. This doesn‘t mean threatening the debtor, but rather informing them of the steps you're prepared to take if the matter remains unresolved.

Common consequences might include:

- Reporting the debt to credit agencies

- Engaging a collection agency

- Pursuing legal action

Here‘s a way to phrase this without sounding overly aggressive:

Should payment not be received by [Deadline], I may be compelled to take further action, including but not limited to engaging a collection agency or pursuing this matter in court. These actions can incur additional costs and affect your credit rating.

Clearly stating the stakes can sometimes provide the necessary motivation for the debtor to prioritize settling the debt.

Polishing Your Letter: Tips for a Professional Finish

Once you‘ve drafted your letter, take a moment to revise and polish. Here are some tips to ensure it reads well and maintains a professional tone:

- Proofread: Spelling and grammatical errors can undermine your professionalism. Double-check your letter or have someone else read it over.

- Tone: Maintain a balance between firmness and politeness throughout the letter.

- Clarity: Avoid jargon or overly complex language. The goal is to be clear and concise.

- Contact Information: Ensure your contact details are easy to find so the debtor knows how to reach you.

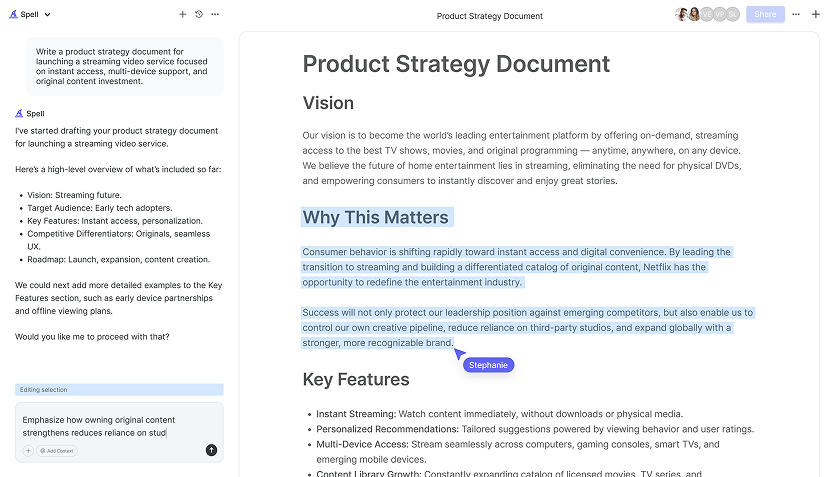

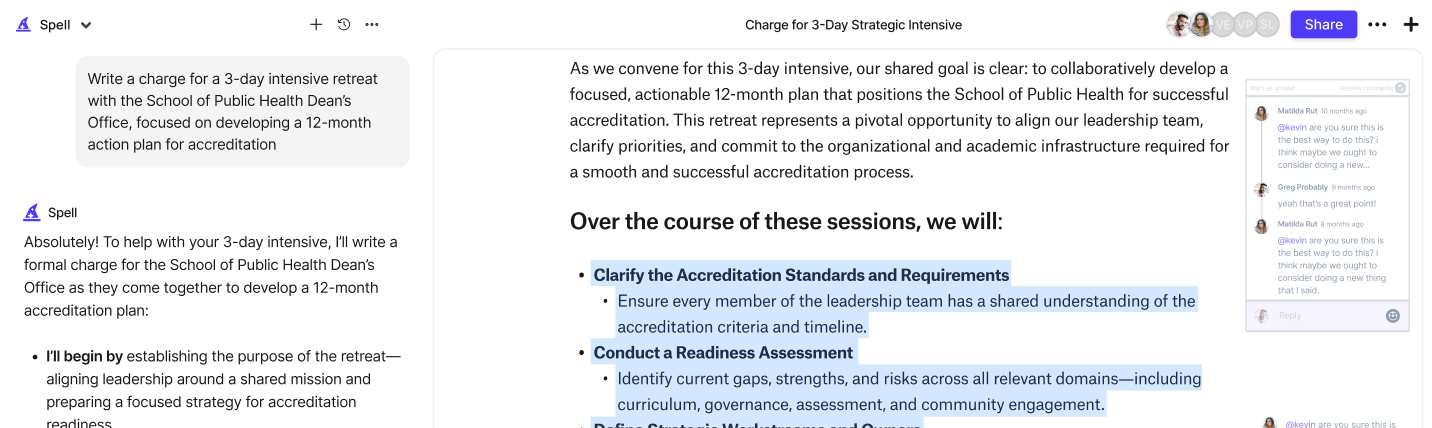

Consider using Spell to draft and refine your demand letter. Our AI-powered document editor can help you polish your letter with ease, ensuring it's both professional and effective.

Sending Your Letter: Choosing the Right Method

After perfecting your demand letter, consider the best way to send it. While email is convenient, a physical letter can sometimes be more impactful, especially if you need a record of delivery. Here are some options:

- Email: Quick and easy, but make sure to request a read receipt.

- Certified Mail: Provides proof of delivery, which can be useful if the issue escalates.

- Hand Delivery: If feasible, hand-delivering the letter can add a personal touch.

Each method has its pros and cons, so choose the one that best suits your needs and the nature of your relationship with the debtor.

Following Up: Keeping the Lines of Communication Open

If you don‘t receive a response or payment by the deadline, a follow-up is necessary. A reminder letter or a phone call can often nudge the debtor into action. Here‘s how to follow up effectively:

- Send a Reminder: A brief message reiterating your previous points can be helpful.

- Make a Call: Sometimes a direct conversation can resolve misunderstandings more quickly than written communication.

- Be Persistent: Keep the communication professional and consistent, but don‘t harass the debtor.

Here's a sample follow-up message:

Dear [Debtor's Name],

I am writing to follow up on my previous communication regarding the outstanding payment of $[Amount] due on [Due Date]. Please let me know if you have any questions or need further clarification.

Remember, persistence often pays off, and keeping the conversation open can lead to a resolution without further conflict.

Final Thoughts

Writing an effective demand letter for payment is about clarity, professionalism, and persistence. By following these steps and using tools like Spell, you can craft a letter that communicates your message clearly and effectively. With patience and the right approach, you can often resolve payment issues without the need for additional action.