When faced with mounting debt, negotiating a settlement can be a lifeline. But how do you start that conversation? A well-crafted debt settlement proposal letter can be your best tool. It‘s not just about stating you can‘t pay. It‘s about presenting a clear, considerate plan that creditors can agree to. In this post, we‘ll break down how to write an effective proposal letter that might just help you breathe a little easier.

Why a Debt Settlement Proposal Letter Matters

Your debt settlement proposal letter is more than just a piece of paper. It‘s your chance to show creditors you‘re serious about resolving your debt. Think of it as an opportunity to open a dialogue and demonstrate your willingness to pay, even if it‘s not the full amount owed. But why go through the trouble of writing this letter?

- Shows Good Faith: By proactively reaching out, you show creditors that you‘re taking responsibility for your debt.

- Establishes a Record: Having everything in writing provides a record of your attempts to settle, which can be valuable if disputes arise.

- Offers a Clear Proposal: You present a specific plan for repayment, making it easier for creditors to respond.

While it seems daunting at first, crafting this letter is a critical step toward financial relief. Let‘s break down how to do it effectively.

Gather Your Financial Information

Before you start writing, you‘ll need to gather all relevant financial information. This step is crucial because you‘ll have to provide a clear picture of your financial situation to your creditor. Here‘s what you should have on hand:

- Debt Details: Know exactly how much you owe and to whom. Include account numbers and any correspondence you‘ve had with the creditor.

- Income and Expenses: Prepare a simple statement of your monthly income and expenses. This will help illustrate why you‘re unable to pay the full amount.

- Other Debts: List any other debts you have, so the creditor understands your entire financial picture.

Having these details ready not only makes the writing process smoother but also demonstrates that you‘ve done your homework. It‘s like preparing for a job interview. Being prepared shows you‘re serious.

Opening Your Letter: Setting the Right Tone

Your letter‘s first impression sets the tone for the rest. You want to begin with a respectful and clear opening, acknowledging the situation without sounding desperate or demanding. Here‘s a sample opening:

Dear [Creditor's Name],

I hope this message finds you well. I am writing in regard to my account, [Account Number], with [Creditor‘s Name]. Due to unforeseen financial difficulties, I am unable to continue making full payments. I am committed to resolving this matter and would like to propose a settlement.

Notice how this opening is respectful and straightforward. It identifies the issue without unnecessary detail and shows your willingness to work things out. This sets a positive tone from the beginning.

Explaining Your Financial Situation

Next, provide a brief explanation of your financial difficulties. Be honest but concise. You don‘t need to spill every detail of your personal life. Just enough to make your case. Here‘s an example:

Over the past year, I have faced several financial setbacks, including [briefly describe situation, e.g., "a medical emergency" or "job loss"]. These challenges have affected my ability to maintain my previous payment schedule.

It‘s all about being transparent. You‘re not looking for sympathy. Just understanding. This honesty can often be refreshing for creditors, who are used to evasive tactics.

Proposing a Settlement Amount

Now comes the meat of your letter: proposing a settlement amount. This is where you need to be both realistic and strategic. Consider what you can genuinely afford, and propose that amount. Here‘s how you might frame it:

Given my current financial situation, I would like to propose a settlement of [amount], which is [percentage]% of the total debt owed. I believe this is a fair offer, considering my circumstances, and it‘s one I can manage without further financial strain.

Sometimes, creditors are willing to accept less than the full amount because a partial payment is better than no payment at all. Still, be prepared for negotiation. It‘s like haggling at a market. There‘s usually room to adjust.

Offering a Payment Plan

In some cases, creditors may be more receptive to a settlement if you outline a payment plan. If you can‘t pay the proposed settlement in one lump sum, suggest a viable payment schedule. Here‘s a sample:

I am able to pay [amount] per month over the next [number] months, which will total the settlement amount of [amount]. I am hopeful that this arrangement is acceptable and demonstrates my commitment to resolving this debt.

This shows that you‘re not only willing to settle but have a clear plan to follow through. It‘s all about providing solutions, not just problems.

Highlighting Benefits for the Creditor

Remember, creditors are more likely to agree to a settlement if they see a benefit. Highlight how accepting your proposal is beneficial for them. For instance:

This settlement will allow [Creditor‘s Name] to recover funds quickly without the need for further collection efforts. Additionally, it will provide closure and reduce administrative costs associated with extended debt collection.

It‘s like selling a product. You want to make the deal attractive. By showing them the upside, you increase your chances of getting a favorable response.

Closing the Letter with Confidence

Wrapping up your letter is just as important as how you start it. You want to reiterate your commitment to resolving the debt and express hope for a positive outcome. Here‘s a closing example:

Thank you for considering my proposal. I am eager to resolve this matter amicably and look forward to your positive response. Please feel free to contact me at [your phone number] or [your email address] to discuss this proposal further.

Close with a polite sign-off like Sincerely or Best regards. It leaves the door open for continued communication, which is crucial for negotiation.

Following Up: Patience and Persistence

After sending your letter, be prepared to wait. Creditors often take time to review proposals. You might need to follow up. Here‘s how to handle this part:

- Give it Time: Wait at least two weeks before following up.

- Be Polite: When you do follow up, remain courteous. A simple phone call or email asking if they‘ve had a chance to review your proposal is enough.

- Stay Persistent: If they decline, don‘t be discouraged. Ask what might be an agreeable amount and adjust your offer if possible.

Persistence is key. It‘s like applying for a job. You might not get the first one you apply for, but each attempt brings you closer to success.

Common Mistakes to Avoid

Writing a debt settlement proposal letter can be tricky, and there are common pitfalls to watch out for:

- Being Vague: Avoid vague language. Be clear about your situation and your proposal.

- Overpromising: Don‘t commit to more than you can realistically pay. Overpromising can lead to further financial trouble.

- Emotional Pleas: Keep it professional. While explaining your situation is important, avoid emotional appeals.

Think of this letter as a business proposal. Stick to the facts, and don‘t let emotions cloud your judgment.

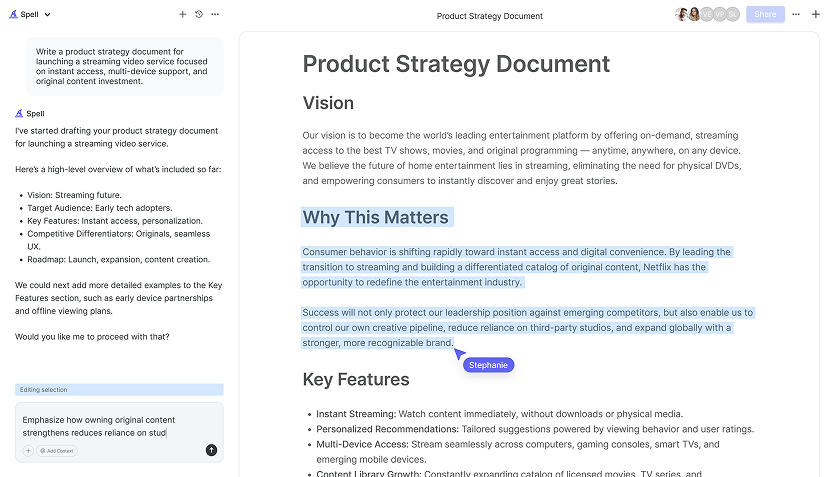

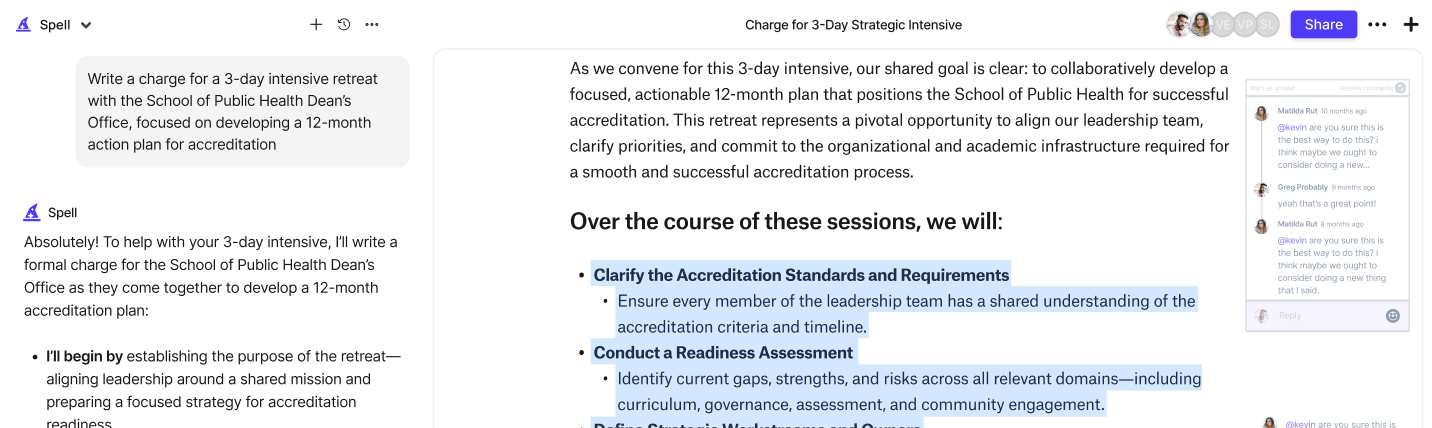

How Spell Can Help You Draft Your Letter

Feeling overwhelmed? That‘s where Spell comes in handy. It‘s like having a writing coach by your side. With Spell, you can draft your proposal letter quickly and efficiently. Just describe what you need, and let Spell generate a professional draft in seconds. You can then refine it as needed, ensuring your letter hits all the right notes.

Spell is especially helpful if you‘re struggling to find the right words. It‘s like having an editor who never judges. Just provides the support you need to get the job done.

Reviewing and Sending Your Letter

Before you hit send, take the time to review your letter carefully. Here‘s a quick checklist:

- Proofread: Check for spelling and grammar errors. A polished letter reflects well on you.

- Check Facts: Ensure all amounts and account details are accurate.

- Get a Second Opinion: If possible, have someone else read your letter. They might catch something you missed.

Once you‘re satisfied, send your letter by mail or email, depending on the creditor‘s preference. Remember to keep a copy for your records.

Final Thoughts

Writing a debt settlement proposal letter doesn‘t have to be a daunting task. By following these steps, you can craft a letter that clearly communicates your situation and offers a workable solution. With the help of Spell, you can draft and refine your letter quickly, ensuring it‘s both professional and persuasive. Good luck with your negotiations, and remember, persistence pays off!