So, you've decided to sell your car. But instead of a lump sum, the buyer wants to pay you in installments. How do you make sure everything's official and on paper? Crafting a contract for selling a car with payments might sound a bit intimidating. But don't worry. I'm here to break it down for you, step by step, so you can handle it like a pro.

What Should You Include in the Contract?

Before you start drafting, it's good to know what elements are absolutely necessary in a car sale contract, especially when payments are involved. This contract isn't just about the sale. It's about protecting both parties and setting clear expectations. Let's break down the must-have components:

- Names and Contact Information: Begin by listing both the seller‘s and buyer‘s full names and contact details. This makes it easy to identify who‘s involved in the transaction.

- Vehicle Details: Include the make, model, year, VIN (Vehicle Identification Number), and mileage. These details ensure there's no confusion about which vehicle is being sold.

- Sale Price: Clearly state the total sale price of the car.

- Payment Terms: Outline how payments will be made. Will they be monthly? Weekly? Be specific about the amount, due dates, and the method of payment (e.g., bank transfer, check).

- Payment Schedule: A schedule showing each payment's due date can help both parties stay on track.

- Late Payment Penalties: If a payment is missed, are there additional fees? Clarifying this can prevent future misunderstandings.

- Signatures: Both parties should sign and date the contract to confirm their agreement to the terms.

Here's a quick example of how you might start the contract:

Seller: John Doe

Buyer: Jane Smith

Vehicle: 2015 Toyota Camry, VIN: 1HGCM82633A123456

Mileage: 75,000 miles

Total Sale Price: $10,000

Deciding on Payment Terms

Figuring out the payment terms is crucial. You want to be fair. But it's also important to protect your interests. Here‘s how you can set up a clear and manageable payment plan:

Payment Amount and Frequency

The payment amount should be something the buyer can realistically afford, and the frequency should fit both your schedules. For instance, if the total price is $10,000, you might decide on monthly payments of $500 over 20 months.

Due Dates and Grace Periods

Set a specific due date for each payment. Decide if you‘ll allow a grace period (a few extra days for the payment to be made without penalties) and include this in the contract.

Late Fees

It‘s wise to outline any late fees upfront. For example, you might state, A late fee of $50 will apply if a payment is more than five days overdue. This encourages timely payments and gives you a buffer if things go awry.

Here's how a section on payment terms might look:

Payment Terms:

- Amount: $500 monthly

- Due Date: 1st of each month

- Grace Period: 5 days

- Late Fee: $50

How to Handle Ownership and Title Transfer

Transferring the car‘s title is a major step in the selling process. Here's how to navigate it smoothly.

When to Transfer the Title

The title transfer should occur only after the final payment is made. This ensures that the car legally belongs to the buyer only once you've received the full sale price. State this clearly in your contract to avoid any confusion.

Temporary Title Arrangements

Some sellers provide a temporary title or a conditional bill of sale, indicating that once payments are complete, the actual title will be transferred. This can be a good middle ground if you're worried about the buyer defaulting on payments.

Here's an example of how you might phrase this in your contract:

Title Transfer:

- The vehicle title will be transferred to the buyer upon receipt of the final payment.

- Until full payment is received, the seller retains the right to repossess the vehicle if payments are not made as agreed.

Legal Considerations and Protections

Legal jargon can be a bit overwhelming. But protecting your interests is important. Here‘s how to cover your bases.

Documenting Everything

Make sure every detail is documented. If conversations occur about changes in payment dates or amounts, confirm these in writing. This helps if any disputes arise later.

Default Clauses

Including a default clause is wise. This outlines what happens if the buyer fails to make payments. It might state that the vehicle can be repossessed, or legal action might be taken.

Here's how a default clause might read:

Default Clause:

- If the buyer fails to make payments for two consecutive months, the seller has the right to repossess the vehicle.

- The buyer will be responsible for any legal fees incurred by the seller in the process of repossession.

Adding a Personal Touch

Contracts can feel cold and formal. But adding a personal touch can make the process smoother and more pleasant for both parties.

Open Communication

Encourage open communication. Express willingness to discuss any issues the buyer might face during the payment period. It‘s in both parties' best interest to resolve problems amicably.

Flexible Arrangements

While the contract should be firm, a little flexibility can go a long way. If the buyer has a legitimate reason for a late payment, being understanding can foster goodwill and maintain a positive relationship.

The Role of Witnesses

Some people opt to have a witness at the signing of the contract. This can be beneficial, especially if the buyer-seller relationship isn't very strong.

Who Can Be a Witness?

A witness can be any neutral third party, such as a friend or notary. Their role is to confirm that both parties signed the contract willingly.

Why Have a Witness?

Having a witness can add an extra layer of security. If disputes arise later, a witness can verify that both parties agreed to the terms as they're written.

Leveraging Technology for Documentation

While pen and paper still work, using technology can make the process smoother and more efficient.

Digital Contracts

Consider using digital contracts. They're easy to create and store, and platforms like DocuSign allow for secure digital signatures. This can save time and eliminate the need for physical meetings.

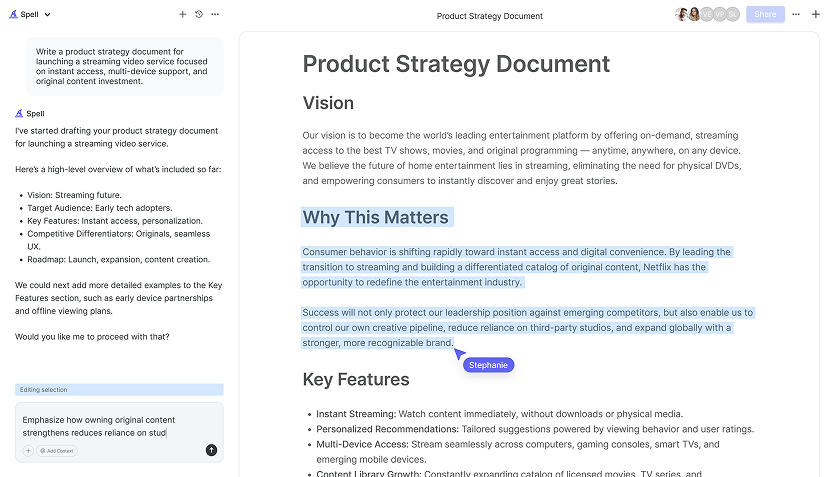

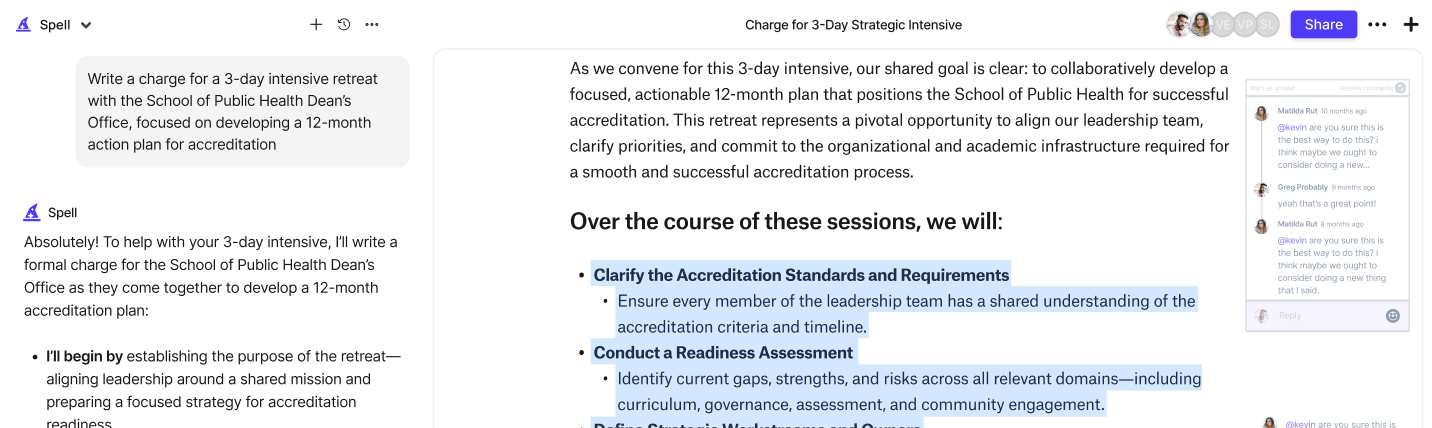

Spell: Your Writing Assistant

If you find drafting the contract a bit daunting, Spell can help. As an AI document editor, Spell can guide you in creating a professional and clear contract, turning a potentially long process into something you can handle in minutes.

Reviewing and Finalizing the Contract

Once your contract is drafted, it's time to review it thoroughly. This step is crucial to catch any potential issues before they become problems.

Proofread and Revise

Read through the contract multiple times. Look for typos or unclear language that might confuse the buyer. It's always good practice to have someone else review it, as they might catch things you missed.

Confirm All Details

Ensure all details are accurate, from names to vehicle information to payment terms. Double-checking now can prevent headaches down the road.

Use Spell to Polish

For a polished final version, you can use Spell to make sure the language is clear and professional. It‘s like having a writing assistant that never gets tired or misses a beat.

Final Thoughts

Writing a contract for selling a car with payments isn't as complex as it might seem. By breaking down each section and focusing on clear communication, you can create a document that protects both you and the buyer. And if you want a bit of help along the way, Spell can make the process even faster and more efficient, turning hours of work into mere minutes.